SOC 2 and HIPAA Compliance: IT Controls Every SMB Must Have in 2026

🎙️ Dive Deeper with Our Podcast!

Summary

Achieving SOC 2 compliance checklist requirements and HIPAA IT compliance isn’t just for enterprise organizations anymore. Small and medium-sized businesses handling sensitive data face increasing pressure from clients, regulators, and insurers to demonstrate robust IT controls. This comprehensive guide explores the essential security frameworks, risk management services, and audit-ready processes every SMB needs in 2025. Whether you’re pursuing formal certification or building baseline protections, understanding these compliance standards helps protect your business from breaches, financial penalties, and reputational damage. Discover how implementing proper IT governance transforms compliance from a checkbox exercise into a competitive advantage that builds customer trust and opens new market opportunities.

Understanding SOC 2 and HIPAA: Why SMBs Can’t Ignore Compliance Anymore

The regulatory landscape has fundamentally shifted for small and medium-sized businesses. What once seemed like “enterprise-only” requirements now affects companies of all sizes.

SOC 2 (Service Organization Control 2) is an auditing framework developed by the American Institute of CPAs (AICPA) that evaluates how organizations manage customer data based on five trust service criteria: security, availability, processing integrity, confidentiality, and privacy. While not legally mandated, SOC 2 has become a de facto requirement for businesses that store customer data in the cloud or provide technology services.

HIPAA (Health Insurance Portability and Accountability Act) establishes mandatory national standards for protecting patient health information. Any business that handles protected health information (PHI)—including healthcare providers, insurance companies, billing services, and their technology vendors—must comply with HIPAA’s Security Rule and Privacy Rule.

Why Compliance Matters More Than Ever in 2026

Several factors have elevated compliance from “nice to have” to business-critical:

Client Requirements: Enterprise customers routinely require SOC 2 reports before signing contracts with technology vendors, service providers, or cloud-based businesses. Without this documentation, you’re excluded from major opportunities before conversations even begin.

Cyber Insurance Mandates: Insurance carriers increasingly require proof of compliance frameworks and documented IT controls before issuing policies or processing claims. Some insurers offer premium discounts for SOC 2 certified organizations.

Regulatory Enforcement: HIPAA violations resulted in over $140 million in settlements in recent years, with the Office for Civil Rights actively investigating breaches affecting fewer than 500 individuals—targeting smaller organizations previously overlooked.

Competitive Differentiation: Demonstrating compliance creates trust with security-conscious customers and positions your business as a serious, professional organization compared to competitors without these certifications.

Breach Prevention: The structured approach required for compliance significantly reduces your actual security risk, not just your paperwork burden.

The Core IT Controls Required for SOC 2 Compliance

SOC 2 isn’t a one-size-fits-all certification. Organizations choose which trust service criteria to include based on their business model, with Security being mandatory and the other four optional.

Access Control Systems

Principle: Only authorized individuals can access systems containing sensitive data, and their access is appropriate to their job function.

Implementation Requirements:

- Multi-factor authentication (MFA) on all systems containing customer data

- Role-based access control (RBAC) limiting permissions to minimum necessary levels

- Automated user provisioning and deprovisioning tied to HR systems

- Regular access reviews (quarterly minimum) with documented approvals

- Privileged access management for administrative accounts

- Session timeout policies preventing unattended access

Common Gaps: Many SMBs implement MFA inconsistently, protecting email but leaving critical applications vulnerable. Auditors specifically look for MFA on remote access, cloud applications, financial systems, and development environments.

Change Management Procedures

Principle: Changes to production systems follow documented, approved processes that minimize disruption and security risks.

Implementation Requirements:

- Formal change request and approval workflow

- Testing environments separated from production

- Documented rollback procedures for failed changes

- Change advisory board reviewing high-risk modifications

- Version control for all code and configuration changes

- Automated deployment processes reducing manual errors

Auditor Focus: Auditors sample random production changes and verify each followed documented procedures. A single emergency change without proper documentation can result in qualified audit opinions.

Data Encryption Standards

Principle: Sensitive data is protected both at rest and in transit using industry-standard encryption.

Implementation Requirements:

- TLS 1.2 or higher for all data transmission

- AES-256 encryption for data at rest

- Encrypted backups stored separately from production systems

- Key management procedures preventing unauthorized decryption

- Database-level encryption for sensitive fields

- Full-disk encryption on laptops and mobile devices

Critical Consideration: Encryption key management often becomes the compliance bottleneck. Keys must be stored separately from encrypted data, rotated regularly, and protected with the same rigor as the data itself.

Monitoring and Incident Response

Principle: Security events are detected, investigated, and resolved through documented processes.

Implementation Requirements:

- Security Information and Event Management (SIEM) system collecting logs

- Automated alerting for suspicious activities

- Documented incident response plan tested annually

- Log retention meeting regulatory requirements (typically 1-7 years)

- Regular vulnerability scanning and penetration testing

- Defined escalation procedures for security incidents

Best Practice: Many SMBs implement excellent detection systems but fail audits due to poor documentation. Every security incident—even false positives—requires documented investigation, resolution, and lessons learned.

Vendor Management Framework

Principle: Third-party service providers with access to customer data maintain equivalent security controls.

Implementation Requirements:

- Vendor security assessments before engagement

- Contractual security requirements in all vendor agreements

- Annual SOC 2 report collection from critical vendors

- Vendor access reviews ensuring principle of least privilege

- Documented vendor offboarding procedures

- Business continuity plans addressing vendor failures

Reality Check: If your payment processor, cloud hosting provider, or backup service suffers a breach, you’re still responsible to your customers. Vendor risk management isn’t delegation—it’s an extension of your own compliance program.

HIPAA IT Compliance Requirements for Healthcare Organizations

HIPAA’s Security Rule establishes national standards for protecting electronic protected health information (ePHI). Unlike SOC 2’s voluntary framework, HIPAA compliance is legally mandatory for covered entities and business associates.

Administrative Safeguards: The Foundation

Administrative safeguards represent management-level controls governing employee behavior and organizational policies.

Security Management Process: Conduct regular risk assessments identifying threats to ePHI, implement security measures reducing risks to reasonable levels, document sanction policies for violations, and review information system activity through audit logs.

Workforce Security: Implement authorization and supervision procedures ensuring workforce members access only necessary ePHI, establish workforce clearance procedures verifying appropriate access, and create termination procedures removing system access for separated employees.

Information Access Management: Isolate healthcare clearinghouse functions from other operations, implement access authorization policies granting ePHI access based on role, and establish access modification procedures responding to workforce changes.

Security Awareness and Training: Provide security reminders about emerging threats, protect against malicious software through endpoint protection, monitor login attempts detecting unauthorized access, and implement password management requiring strong credentials.

Contingency Planning: Develop data backup plans ensuring ePHI recoverability, create disaster recovery plans restoring critical systems, establish emergency mode operations maintaining ePHI security during crises, test contingency plans annually, and maintain applications and data criticality assessments.

Technical Safeguards: Protecting the Data

Technical safeguards involve the technology and policies protecting ePHI and controlling access to it.

Access Control: Implement unique user identification assigning distinct usernames to each person, establish emergency access procedures providing ePHI access during emergencies, create automatic logoff terminating sessions after inactivity, and use encryption and decryption mechanisms protecting ePHI when deemed appropriate.

Audit Controls: Implement hardware, software, and procedural mechanisms recording and examining activity in systems containing ePHI. This isn’t optional—it’s a required implementation specification.

Integrity Controls: Implement electronic mechanisms corroborating ePHI hasn’t been altered or destroyed improperly. This typically involves checksums, digital signatures, or version control systems.

Transmission Security: Implement integrity controls ensuring ePHI isn’t improperly modified during transmission and encryption mechanisms protecting ePHI transmitted over electronic networks.

Physical Safeguards: Controlling the Environment

Physical safeguards protect the facilities, equipment, and physical media storing ePHI.

Facility Access Controls: Implement contingency operations establishing procedures allowing facility access supporting data restoration, create facility security plans protecting facilities from unauthorized access, develop access control and validation procedures controlling physical access based on role, and maintain maintenance records documenting facility repairs affecting security.

Workstation Use: Implement policies specifying proper workstation functions, acceptable physical surroundings, and security measures protecting ePHI accessibility.

Workstation Security: Implement physical safeguards limiting workstation access to authorized users only. This includes privacy screens, locked offices, and secured portable devices.

Device and Media Controls: Establish disposal procedures removing ePHI before equipment disposal, create media reuse procedures ensuring ePHI removal before media reuse, maintain accountability tracking movements of hardware and media, and implement data backup and storage procedures creating retrievable ePHI copies.

The Business Associate Problem

One of HIPAA’s most misunderstood aspects involves business associate relationships. If you handle PHI on behalf of a covered entity, you’re a business associate subject to HIPAA requirements—even if you never see the data.

Common Business Associate Scenarios:

- Cloud hosting providers storing healthcare application data

- IT support companies accessing servers containing PHI

- Billing services processing healthcare claims

- Email providers hosting covered entity accounts

- Shredding companies destroying documents with PHI

- Consultants analyzing patient data

Critical Requirement: Business associate agreements (BAAs) must be executed BEFORE any PHI exposure. Auditors routinely request BAA documentation, and missing agreements represent serious violations even without actual breaches.

Building an Audit-Ready IT Environment

Compliance isn’t about passing a one-time audit—it’s about maintaining consistent controls year-round. Audit preparation should be an ongoing process, not a panic-driven sprint before the auditor arrives.

Documentation That Actually Passes Audits

Auditors operate on a simple principle: if it isn’t documented, it didn’t happen. Even perfect security practices fail audits without proper evidence.

Policy Documentation Requirements:

- Formal written policies approved by executive leadership

- Annual review dates with documented updates

- Version control showing policy evolution

- Distribution records proving employee awareness

- Exception procedures for unavoidable violations

- Clear ownership assignment for each policy area

Evidence Collection Systems:

- Automated logging capturing security events

- Ticket systems documenting change requests

- Training completion records with test scores

- Access review spreadsheets with approval signatures

- Vendor assessment reports and SOC 2 collections

- Incident response investigations and resolutions

Common Documentation Failures:

- Policies existing but never communicated to staff

- Training completed but no completion records

- Access reviews conducted mentally without documentation

- Verbal approvals for changes lacking written records

- Incident investigations concluded without written summaries

- Vendor assessments performed but not retained

Continuous Monitoring vs. Point-in-Time Compliance

The shift from annual audits to continuous compliance monitoring represents a fundamental change in how organizations approach risk management services.

Traditional Approach Problems:

- Compliance viewed as annual event rather than ongoing state

- “Audit prep mode” creating temporary compliance improvements

- Control drift between audits going undetected

- Reactive posture addressing findings after discovery

Continuous Monitoring Benefits:

- Real-time visibility into control effectiveness

- Automated evidence collection reducing manual effort

- Proactive issue identification before audits

- Compliance dashboard showing current status

- Reduced audit duration through better preparation

Implementation Strategy:

- Deploy compliance management platforms tracking control status

- Automate evidence collection wherever possible

- Establish monthly control testing schedules

- Create compliance scorecard reviewed by leadership

- Implement continuous vendor monitoring

- Develop exception management workflows

Internal Audit Programs

Waiting for external auditors to discover gaps wastes time and money. Internal audit programs identify issues while you can still fix them without qualified opinions.

Quarterly Internal Audit Cycle:

Q1 – Access Controls: Review user permissions, test MFA implementation, verify terminated employee access removal, audit privileged account usage, and assess vendor access appropriateness.

Q2 – Change Management: Sample recent production changes, verify approval documentation, test rollback procedures, review change success rates, and assess emergency change handling.

Q3 – Data Protection: Test encryption implementation, verify backup integrity, review data classification, assess data retention compliance, and evaluate data disposal procedures.

Q4 – Monitoring and Response: Review security logs for gaps, test incident response procedures, verify alert effectiveness, assess vulnerability management, and evaluate third-party security reports.

Internal Audit Documentation: Each internal audit should produce a formal report identifying findings, assessing risk levels, recommending remediation, assigning ownership, and establishing resolution deadlines. Track remediation status monthly and escalate overdue items to executive leadership.

The SOC 2 Compliance Checklist: Step-by-Step Implementation

Achieving SOC 2 certification involves a structured process typically requiring 6-12 months for organizations starting from scratch.

Phase 1: Scoping and Readiness (Months 1-2)

Define Audit Scope: Determine which systems, applications, and processes will be included in the SOC 2 audit. Broader scope provides more customer value but increases complexity and cost.

Select Trust Service Criteria: Decide whether pursuing Type I (point-in-time) or Type II (operating effectiveness over time, typically 6-12 months) and which criteria beyond Security to include.

Conduct Gap Assessment: Compare current controls against SOC 2 requirements, identify missing controls, evaluate existing control effectiveness, and estimate remediation effort and timeline.

Engage Audit Firm: Select a CPA firm experienced with SOC 2 audits in your industry, negotiate audit scope and fees, and establish audit timeline.

Phase 2: Control Implementation (Months 3-6)

Develop Policy Framework: Create comprehensive information security policies, establish change management procedures, document incident response plans, implement business continuity strategies, and formalize vendor management processes.

Deploy Technical Controls: Implement multi-factor authentication across all systems, establish role-based access controls, deploy SIEM or logging solutions, configure encryption for data at rest and in transit, and establish vulnerability scanning programs.

Establish Operational Procedures: Create access review workflows, implement change approval processes, establish security awareness training, develop incident investigation procedures, and formalize vendor assessment processes.

Document Everything: Record policy approvals and distribution, maintain evidence of control operation, create audit trails for all activities, establish centralized documentation repository, and implement version control for all documents.

Phase 3: Operating Period (Months 7-12 for Type II)

For Type II audits, controls must operate effectively for a specified period (typically 6-12 months) before the audit. This phase proves controls work consistently, not just exist on paper.

Continuous Control Operation: Execute access reviews quarterly, process changes through approval workflows, conduct security training for new hires, investigate and document security incidents, and collect vendor SOC 2 reports annually.

Evidence Collection: Automate log collection and retention, maintain change management tickets, preserve training completion records, document incident investigations, and organize vendor documentation.

Monthly Control Testing: Sample control operation for effectiveness, identify and remediate control failures, escalate issues requiring attention, document remediation activities, and report status to leadership.

Phase 4: Audit Execution (Month 12+)

Readiness Assessment: Conduct pre-audit internal review, organize evidence for auditor requests, brief key personnel on audit process, and prepare workspace for auditors.

Audit Fieldwork: Provide requested documentation promptly, facilitate auditor interviews with staff, demonstrate control operation, address auditor questions thoroughly, and maintain professional cooperation.

Audit Report: Receive draft report identifying findings, provide management responses to findings, negotiate report language, receive final SOC 2 report, and distribute to customers as appropriate.

Common Compliance Pitfalls and How to Avoid Them

Even well-intentioned organizations make predictable mistakes that derail compliance efforts or result in qualified audit opinions.

Pitfall 1: Treating Compliance as IT-Only Initiative

The Problem: Organizations assign compliance responsibility solely to IT teams without executive sponsorship or cross-functional involvement.

Why It Fails: Effective compliance requires policy decisions, budget approvals, workflow changes, and cultural shifts beyond IT’s authority. When compliance conflicts with business convenience, IT loses without executive backing.

The Solution: Establish compliance steering committee with executive representation, assign executive sponsor with budget authority, involve HR in workforce procedures, engage legal counsel for policy review, include finance in vendor contracts, and make compliance a board-level discussion.

Pitfall 2: Policy-Practice Disconnect

The Problem: Organizations create comprehensive policies that don’t reflect actual operational reality, leading to policies nobody follows and practices that violate stated policies.

Why It Fails: Auditors test whether practices match policies. When they don’t, you fail the audit even if your actual practices are reasonable. Policies become liability rather than protection.

The Solution: Write policies describing actual practices, not aspirational states. Implement changes before documenting them. Involve practitioners in policy development. Review policies annually against operations. Update policies when practices evolve legitimately. Train staff on actual requirements.

Pitfall 3: Documentation Neglect

The Problem: Controls operate effectively but lack documentation proving it, creating audit failures despite good security posture.

Why It Fails: “If it isn’t documented, it didn’t happen” isn’t auditor pickiness—it’s the fundamental principle of third-party verification. Without evidence, auditors can’t confirm control operation.

The Solution: Build documentation into workflows rather than bolting it on afterward. Use ticketing systems for changes and incidents. Implement training platforms tracking completion. Create access review templates requiring signatures. Establish vendor management spreadsheets. Schedule monthly documentation reviews.

Pitfall 4: Vendor Risk Ignorance

The Problem: Organizations implement strong internal controls but ignore third-party risks, assuming vendors maintain equivalent security without verification.

Why It Fails: Your compliance obligations don’t end at your network perimeter. Vendor breaches affect your customers and your compliance status. Auditors scrutinize vendor management heavily.

The Solution: Maintain vendor inventory including security criticality ratings. Collect SOC 2 reports from critical vendors annually. Include security requirements in all vendor contracts. Conduct security assessments before vendor engagement. Review vendor access quarterly. Establish vendor incident notification requirements. Develop contingency plans for vendor failures.

Pitfall 5: Compliance Theater

The Problem: Organizations implement controls to pass audits without actually improving security, creating checkbox compliance that provides false confidence.

Why It Fails: Controls designed for audit passage rather than risk reduction often miss the point entirely. When real incidents occur, ineffective controls fail to protect.

The Solution: Start with risk assessment identifying actual threats. Design controls addressing real risks. Test controls against realistic scenarios. Measure control effectiveness, not just existence. Involve security professionals in design. Focus on outcomes, not activities. Continuously improve based on lessons learned.

How HIPAA and SOC 2 Overlap (And Where They Differ)

Organizations handling healthcare data often pursue both HIPAA compliance and SOC 2 certification. Understanding the relationship between frameworks prevents duplicate effort while ensuring both requirements are met.

Common Ground: Shared Requirements

Many controls satisfy both frameworks simultaneously:

Access Controls: Both require unique user identification, role-based permissions, multi-factor authentication for remote access, and regular access reviews.

Encryption: Both mandate encryption for data in transit, encryption for data at rest (HIPAA allows risk-based decisions; SOC 2 expects implementation), and secure key management.

Audit Logging: Both require comprehensive logging of system access, security event monitoring, log retention, and regular log review.

Incident Response: Both expect documented incident response plans, defined investigation procedures, notification protocols, and lessons learned processes.

Risk Assessments: Both require regular risk assessments, documented risk treatment decisions, and executive involvement in risk acceptance.

Critical Differences: Where Frameworks Diverge

Legal vs. Voluntary:

- HIPAA compliance is legally mandatory for covered entities and business associates

- SOC 2 is voluntary but often contractually required by customers

- HIPAA violations carry federal penalties up to $1.9 million per violation category per year

- SOC 2 failures don’t trigger legal penalties but damage business relationships

Scope Definition:

- HIPAA applies to all systems, processes, and vendors touching PHI

- SOC 2 scope can be limited to specific systems or services

- HIPAA requires company-wide compliance

- SOC 2 can exclude non-customer-facing systems

Audit Frequency:

- HIPAA requires continuous compliance without mandatory external audits (though OCR can investigate anytime)

- SOC 2 involves annual third-party audits

- HIPAA assessments are often internal or consultant-led

- SOC 2 requires CPA firm attestation

Documentation Specifics:

- HIPAA requires specific documentation like BAAs, risk assessments, and breach notifications

- SOC 2 requires control descriptions, evidence of operation, and management assertions

- HIPAA focuses on regulatory compliance evidence

- SOC 2 emphasizes customer-facing assurance

Leveraging Frameworks Together

Smart organizations build integrated compliance programs addressing both frameworks:

Unified Control Framework: Implement controls meeting both requirements simultaneously. Design access controls satisfying HIPAA addressable specifications and SOC 2 common criteria. Build encryption programs exceeding both baselines.

Consolidated Documentation: Create policy framework addressing both regulations. Develop single incident response plan with HIPAA-specific breach notification appendix. Maintain unified risk register with HIPAA and SOC 2 views.

Integrated Auditing: Schedule internal audits covering both frameworks. Engage auditors familiar with healthcare and SOC 2. Present SOC 2 reports to HIPAA regulators as compliance evidence. Use SOC 2 findings to improve HIPAA posture.

Choosing the Right Compliance Partner

Achieving and maintaining compliance requires specialized expertise most SMBs don’t have in-house. The right partner transforms compliance from overwhelming burden to manageable process.

What to Look for in Risk Management Services

Industry Experience: Seek providers with demonstrated success in your specific industry, understanding of relevant regulations, and familiarity with industry-specific challenges.

Compliance Credentials: Verify certifications like Certified Information Systems Security Professional (CISSP), Certified Information Security Manager (CISM), Certified in Risk and Information Systems Control (CRISC), and healthcare-specific credentials for HIPAA work.

Technology Platform: Evaluate whether providers use compliance management platforms, automation capabilities, evidence collection systems, and reporting dashboards.

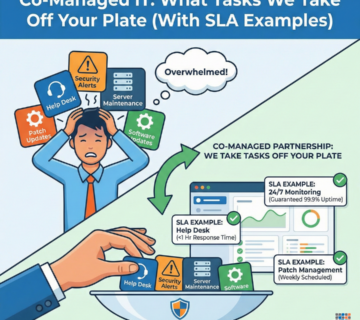

Service Model Options: Understand whether providers offer fully managed compliance services, co-managed models with internal teams, or consulting and advisory only.

Transparent Pricing: Request clear pricing models, understand what’s included versus additional fees, and evaluate total cost of ownership including technology and services.

Red Flags to Avoid

Compliance Guarantees: No legitimate provider guarantees audit passage or regulatory approval. Compliance involves subjective judgment and changing requirements.

One-Size-Fits-All Approaches: Effective compliance programs are tailored to specific business models, risk profiles, and operational realities.

Vendor Lock-In: Avoid providers requiring proprietary platforms you can’t extract data from or long-term contracts without exit clauses.

Limited Documentation: Quality providers document their own processes, deliverables, and responsibilities clearly.

Audit Firm Conflicts: Be cautious when audit firms offer implementation services, as this creates independence issues. Use separate firms for implementation and auditing.

Frequently Asked Questions

How long does it take to achieve SOC 2 compliance?

Organizations typically require 6-12 months to achieve SOC 2 Type I (point-in-time audit) starting from minimal existing controls. SOC 2 Type II requires an additional 6-12 month operating period demonstrating controls work consistently over time. Organizations with existing security programs may achieve compliance faster, while those starting from scratch should expect the full timeline. The complexity of your systems, number of integrated vendors, and availability of internal resources significantly impact duration.

What’s the difference between SOC 2 Type I and Type II?

SOC 2 Type I reports provide an auditor’s opinion on whether your control design is suitable to meet trust service criteria at a specific point in time. SOC 2 Type II reports provide opinion on both control design and operating effectiveness over a period (typically 6-12 months), demonstrating controls actually function as described consistently. Type II reports carry significantly more weight with customers and provide greater assurance, but require longer timelines and more extensive testing. Most enterprise customers require Type II reports before contract signing.

Does HIPAA compliance require annual audits?

HIPAA doesn’t mandate annual third-party audits for all covered entities. However, HIPAA requires periodic security risk assessments (most organizations conduct them annually) and continuous compliance with Security Rule requirements. The Office for Civil Rights can investigate any organization at any time, and many organizations conduct voluntary audits to verify compliance status and identify gaps before regulatory scrutiny. Cyber insurance carriers increasingly require documented HIPAA assessments or audits as policy conditions.

Can small businesses afford SOC 2 compliance?

SOC 2 compliance costs vary dramatically based on organization size, complexity, and existing controls, typically ranging from $20,000-$100,000+ for first-year implementation and audit. However, the cost of NOT achieving SOC 2 often exceeds compliance costs for businesses selling to enterprise customers. Lost contract opportunities, customer churn, and competitive disadvantage create real revenue impact. Many SMBs phase compliance implementation over multiple quarters, implement controls themselves using external guidance, and choose focused audit scopes minimizing costs while meeting customer requirements.

What happens if we fail a SOC 2 audit?

SOC 2 audits don’t use pass/fail terminology. Instead, auditors issue opinions ranging from unqualified (clean) to qualified (with exceptions) to adverse (controls inadequate). Qualified opinions identify specific control failures but still provide customer assurance in other areas. Organizations receiving qualified opinions can remediate issues and request re-audit of affected areas. Most customers accept qualified opinions if exceptions are minor and management responses demonstrate remediation plans. Completely failing SOC 2 typically results from fundamental control absence, not operational gaps.

Are cloud services automatically HIPAA compliant?

No. Cloud service providers can be HIPAA compliant and willing to sign business associate agreements, but this doesn’t make YOUR use of their service compliant. You remain responsible for configuring services securely, managing access appropriately, encrypting data, maintaining audit logs, and all other HIPAA requirements. Choosing a HIPAA-compliant cloud provider is necessary but insufficient—you must implement proper controls on your end. Additionally, some cloud services don’t offer HIPAA-compliant configurations at all service tiers, requiring enterprise plans for compliance features.

How often should we conduct risk assessments?

HIPAA requires risk assessments whenever significant changes occur to your environment and as periodic practice (most organizations choose annually). SOC 2 expects annual risk assessments at minimum, with updates when major changes occur. Best practice involves annual comprehensive assessments, quarterly reviews of high-risk areas, and immediate assessments when implementing new systems, experiencing security incidents, or facing new threat vectors. Risk assessment isn’t a once-and-done compliance checkbox—it’s an ongoing process informing security investments and control prioritization.

Can we handle compliance internally or do we need external help?

Organizations can achieve compliance using internal resources if they possess necessary expertise, available time, and executive support. However, most SMBs lack dedicated compliance professionals with current regulatory knowledge, audit experience, and time availability outside daily responsibilities. External providers offer expertise, efficiency, and objective perspective internal teams struggle to provide. Many organizations adopt hybrid approaches: using external consultants for gap assessments and framework development while handling ongoing operational tasks internally, or engaging managed services for technical implementation while retaining policy and governance internally.

What’s the ROI of compliance programs?

Direct ROI comes from contract opportunities requiring compliance, reduced cyber insurance premiums, faster sales cycles with security-conscious customers, and premium pricing for certified services. Indirect ROI includes reduced breach risk (average breach cost exceeds $4 million), regulatory fine avoidance, improved operational efficiency through documented processes, and competitive differentiation. Most organizations pursuing compliance for customer requirements discover unexpected benefits in reduced security incidents, improved internal communications, and better vendor management. Compliance programs that start as cost centers often become business enablers opening new markets.

How do we maintain compliance after achieving certification?

Maintaining compliance requires continuous operation of implemented controls, regular evidence collection, ongoing training, periodic policy reviews, vendor management, internal audits, and annual re-certification. Organizations often struggle with “compliance drift” where controls degrade over time without active maintenance. Successful programs assign clear ownership, automate evidence collection, implement compliance management platforms, conduct quarterly internal audits, and maintain executive visibility through regular reporting. Compliance should become embedded in operational workflows rather than existing as separate parallel processes.

How Technijian Can Help: Your Partner for Compliance Success

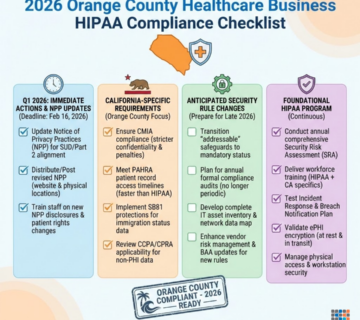

Navigating SOC 2 and HIPAA requirements while running your business creates significant challenges. Technijian’s Compliance & IT Governance services provide the expertise, tools, and ongoing support Orange County and Southern California SMBs need to achieve and maintain certification.

Comprehensive Compliance Readiness Assessments

Our process begins with thorough evaluation of your current state against SOC 2 compliance checklist requirements and HIPAA regulations. We assess existing controls, identify gaps, evaluate risk exposure, and develop prioritized roadmaps tailored to your business objectives, timeline, and budget constraints. Our assessments provide clear visibility into required investments, realistic timelines, and expected outcomes before you commit resources.

Compliance Framework Implementation

Technijian implements complete compliance frameworks including policy development, technical control deployment, workflow integration, and evidence collection systems. Our managed IT services approach means we handle implementation details while your team focuses on business operations. We leverage proven frameworks customized to your specific industry requirements, ensuring controls address real risks rather than checking boxes.

Ongoing Compliance Management

Achieving compliance is just the beginning—maintaining it requires continuous attention. Our risk management services include quarterly access reviews, monthly control testing, vendor management oversight, security awareness training, incident response support, and annual re-certification coordination. We provide compliance dashboards offering real-time visibility into control status, upcoming requirements, and potential issues before they impact audits.

Integrated Security and Compliance

Unlike providers treating compliance as separate from security, Technijian integrates compliance requirements into comprehensive cybersecurity programs. Our approach ensures controls actually improve security posture while satisfying regulatory requirements. We implement advanced threat detection, vulnerability management, backup and disaster recovery, endpoint protection, and network security alongside compliance controls, creating defense-in-depth protecting your business and satisfying auditors.

Healthcare-Specific HIPAA Expertise

For healthcare organizations and business associates, Technijian provides specialized HIPAA IT compliance services understanding the unique challenges of protecting patient information. We implement comprehensive administrative, technical, and physical safeguards, assist with business associate agreement management, provide breach response planning and support, conduct regular HIPAA security risk assessments, and maintain documentation satisfying Office for Civil Rights investigations.

Proven Track Record Across Southern California

Technijian has successfully guided dozens of Orange County and Southern California businesses through SOC 2 and HIPAA compliance journeys. Our clients include healthcare providers, technology companies, financial services firms, professional services organizations, and manufacturing businesses facing increasing compliance pressures from customers and regulators.

Technology-Enabled Compliance Programs

We leverage leading compliance management platforms providing automated evidence collection, continuous control monitoring, policy management systems, training delivery and tracking, vendor risk management tools, and executive reporting dashboards. Our technology-first approach reduces manual burden while improving audit readiness and control effectiveness.

Transparent Engagement Models

Technijian offers flexible engagement options matching your needs and budget: fully managed compliance services handling everything end-to-end, co-managed models partnering with your internal IT team, project-based implementations for specific compliance initiatives, and ongoing advisory support for organizations maintaining compliance internally.

Request Your Compliance Readiness Assessment

Stop wondering whether your organization can pass SOC 2 or HIPAA audits. Technijian’s comprehensive compliance readiness assessment provides clear answers, actionable roadmaps, and realistic timelines for achieving certification.

Our assessment includes:

- Gap analysis against SOC 2 or HIPAA requirements

- Risk evaluation identifying highest-priority concerns

- Detailed remediation roadmap with effort estimates

- Technology recommendations addressing control gaps

- Budget and timeline projections

- Executive summary for leadership decision-making

Contact Technijian today to schedule your compliance readiness assessment and transform compliance from overwhelming burden into competitive advantage. Our Orange County-based team serves businesses throughout Southern California with the expertise, tools, and support needed to navigate today’s complex regulatory landscape while protecting your customers, reputation, and business operations.

Ready to build audit-ready IT controls and achieve compliance confidence? Contact Technijian for your comprehensive compliance readiness assessment and discover how our Compliance & IT Governance services can position your business for success in 2026 and beyond.